The last Word Information to Buying Gold: Discover one of the Best Locations for your Funding

In an era of economic uncertainty and fluctuating currencies, gold has emerged as a reliable investment option for many. Its intrinsic value and timeless enchantment make it a coveted asset for both seasoned buyers and newcomers. But the place is the best place to buy gold? This text explores the highest destinations for purchasing gold, making certain you make an informed decision to your funding needs.

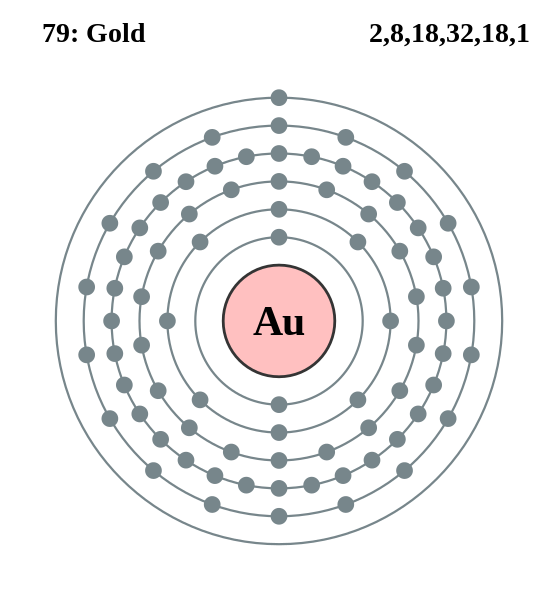

Understanding the Gold Market

Before diving into one of the best places to buy gold, it is important to know the gold market. Gold prices fluctuate primarily based on various factors, including world economic conditions, foreign money power, and demand from industries and consumers. Traders usually buy gold in several varieties: coins, bars, jewelry, or alternate-traded funds (ETFs). Each option has its execs and cons, which shall be discussed later in this text.

Local Jewelers: A personal Contact

One of the conventional places to buy gold is at local jewelers. These institutions usually have a large number of gold jewellery and can present customized service. Shopping for from a jeweler permits you to see the product in individual, assess its quality, and ask questions on its provenance. Additionally, local jewelers could supply distinctive items that you won’t find wherever else.

However, it’s crucial to do your homework earlier than purchasing from a jeweler. Analysis their popularity, read customer opinions, and guarantee they’re transparent about pricing and high quality. Look for jewelers who provide certification for his or her gold merchandise, as this may also help verify authenticity.

Online Retailers: Convenience and Selection

In today’s digital age, on-line retailers have become a well-liked alternative for buying gold. Websites like APMEX, JM Bullion, and Kitco offer in depth selections of gold coins, bars, and even jewelry. The convenience of shopping from residence, coupled with the power to compare costs simply, makes on-line shopping a sexy possibility.

When purchasing gold on-line, ensure you select a reputable supplier. Look for retailers that supply safe cost options, clear pricing, and a clear return coverage. Moreover, examine if they provide insurance for delivery, as this could protect your investment during transit.

Gold Exchanges: Direct Access to the Market

For critical buyers, gold exchanges could be a superb choice. These platforms permit you to buy and promote gold immediately in the marketplace, usually at competitive costs. Exchanges just like the London Bullion Market Affiliation (LBMA) and the new York Mercantile Alternate (NYMEX) present access to professional traders and institutional buyers.

Whereas buying gold through an trade can yield vital financial savings, it sometimes requires the next degree of information and experience. Traders must be conversant in trading practices and market trends to navigate this selection successfully. Moreover, consider the fees associated with trading on exchanges, as they can impact your total funding returns.

Gold Funds and ETFs: A Problem-Free Strategy

For those who desire a more fingers-off strategy to investing in gold, gold funds and alternate-traded funds (ETFs) are excellent alternatives. These monetary merchandise enable investors to achieve publicity to gold with out the necessity to physically hold the steel. Gold ETFs, such because the SPDR Gold Shares (GLD), monitor the price of gold and can be purchased and sold like stocks on the inventory exchange.

Investing in gold funds and ETFs offers several advantages, including liquidity, diversification, and lower transaction costs. Nonetheless, it is essential to analysis the fund’s administration charges and performance historical past earlier than investing. Additionally, remember the fact that you won’t personal bodily gold, which may be a downside for some investors.

Auctions: Unique Opportunities for Collectors

For these enthusiastic about collectible gold gadgets, auctions generally is a treasure trove of unique alternatives. Public sale houses like Sotheby’s and Christie’s often function rare gold coins, jewelry, and artifacts that may be useful additions to any collection. Bidding at auctions can typically yield distinctive offers, particularly for unique or historic pieces.

Nevertheless, taking part in auctions requires cautious consideration and information of the gadgets being bought. It’s important to set a funds and stick with it, as bidding wars can shortly escalate costs. Moreover, familiarize yourself with the public sale home’s charges and terms earlier than inserting a bid.

Native Coin Shops: A Community Connection

Native coin shops are one other excellent possibility for buying gold, particularly for buyers enthusiastic about gold coins. These outlets typically have educated employees who can present worthwhile insights into the gold market and assist you discover the best products in your investment targets. If you cherished this posting and you would like to get far more information pertaining to Highly recommended Web-site kindly pay a visit to our webpage. Moreover, buying from a neighborhood shop helps small companies and fosters neighborhood connections.

When visiting a coin shop, make sure to examine their inventory and pricing. Evaluate costs with other retailers to make sure you’re getting a good deal. Additionally, inquire in regards to the store’s insurance policies on buying again gold, as this can be useful for future liquidity.

Gold Mining Corporations: Investing in Manufacturing

For these trying to invest in gold indirectly, purchasing shares in gold mining firms will be an appealing possibility. Corporations like Barrick Gold and Newmont Company are main players in the gold mining business and may provide exposure to gold prices with out the need to buy physical gold. Investing in mining stocks can offer potential for capital appreciation and dividends, however it additionally comes with risks related to the mining industry.

Before investing in gold mining firms, analysis their financial health, manufacturing costs, and market position. Understanding the operational facets of these corporations can assist you make knowledgeable investment choices.

Conclusion: Making the suitable Alternative

In the end, the best place to buy gold relies upon in your individual preferences, funding targets, and level of experience. Whether or not you choose to purchase from an area jeweler, a web-based retailer, a gold change, or by way of ETFs and mining stocks, conducting thorough analysis is crucial. Understanding the professionals and cons of every option will empower you to make informed selections and build a gold portfolio that aligns with your financial goals.

As you embark on your journey to invest in gold, remember that this precious metallic has stood the test of time as a store of worth. With the appropriate data and assets, you’ll be able to confidently navigate the gold market and secure your financial future.